Federal Inland Revenue Service NG on Twitter: "31st MARCH, 2018 IS THE DUE DATE OF FILING THE FOLLOWING TAX RETURNS: I. Personal Income Tax (PIT) for 2018. II. For companies having 30th

You may be liable to tax on your previously exempted investment income effective from 2 January 2022 - Tax & Business Matters - Nigeria

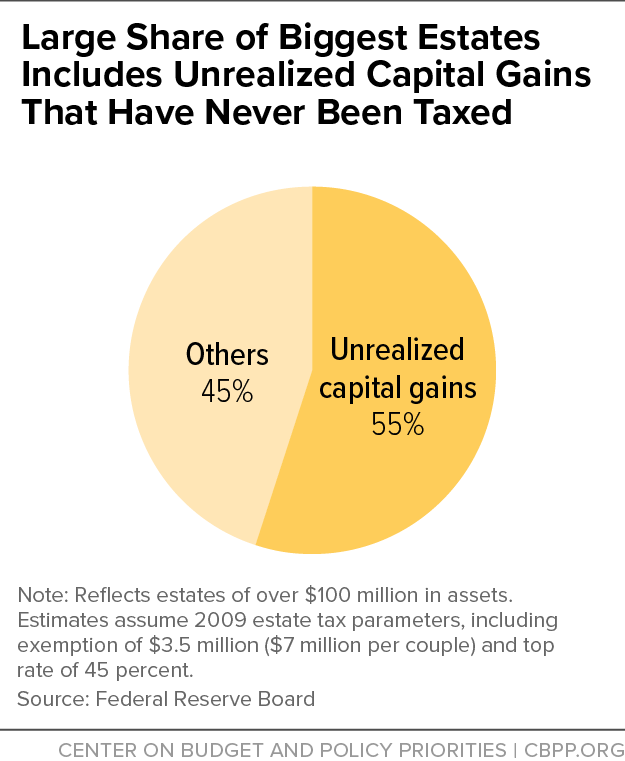

Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks | Center on Budget and Policy Priorities

Deloitte - DELOITTE SCHOOL OF TAX Corporate Income Tax (CIT) Masterclass Date: 21st - 22nd April, 2021 Time: 9:30 am - 2:00 pm each day Fee: Ghc1500 per participant Training Registration Link:

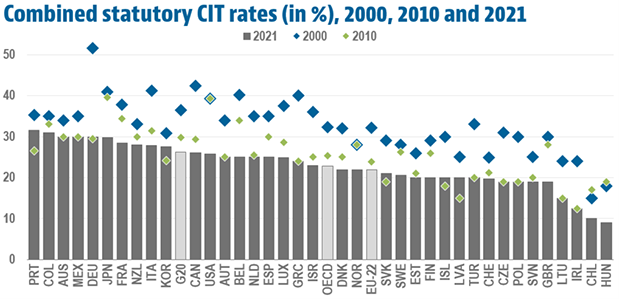

Are Tax Cuts Just Not Cutting It? Improving the Efficiency of the Corporate Tax System - Austaxpolicy: The Tax and Transfer Policy Blog